The Problem With Being House Rich

A Wealth of Common Sense

APRIL 25, 2023

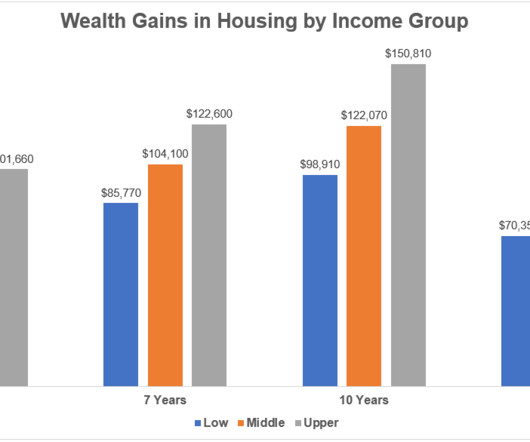

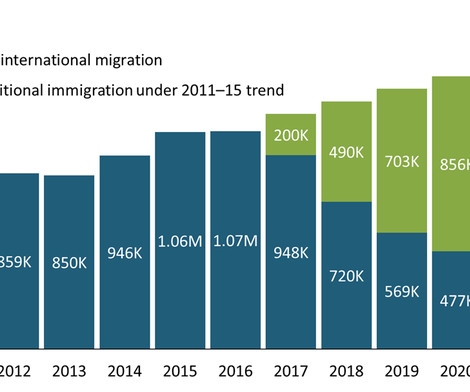

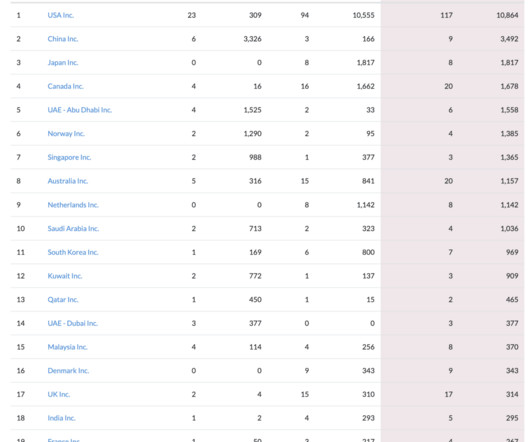

According to the National Association of Realtors, the median price of a house in the United States is worth $190,000 more than it was a decade ago. If you’ve owned a house for more than 3 years or so, you’re likely sitting on some nice gains. Those gains were not evenly distributed but across the various income levels, homeowners have made a good chunk of change: The pandemic-related housing gains are unlike.

Let's personalize your content