If you have invested in the stock market for even a moderate length of time, you know that things change fast. The changes are unpredictable, and yet it is shockingly easy to get caught up in the current Wall Street trends. Don't do it. Here's a better option.

Benjamin Graham's Mr. Market

Warren Buffett is a much-followed investor today, but go back to when he was just starting out as an investor, and the name Benjamin Graham was huge. In fact, Graham was a key mentor for Buffett, helping to instill a value bias into the young stock analyst. (Philip Fisher was the one who trained Buffett on growth stocks, but that's a story for a different article.) One of Graham's best stories was about Mr. Market.

Image source: Getty Images.

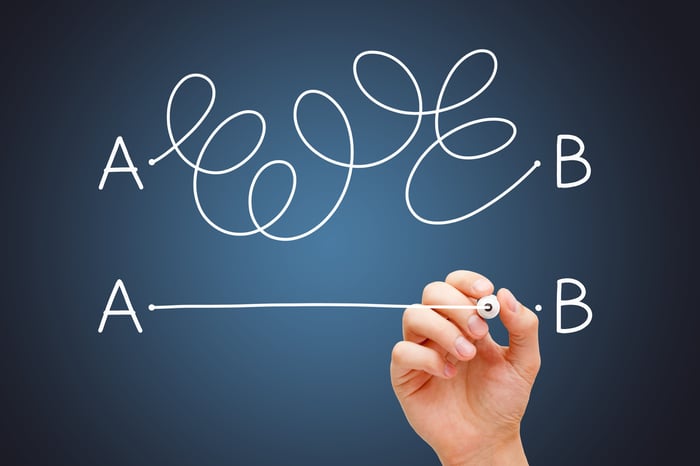

As a way to illustrate the inherent uncertainty of stocks, Graham created a character that was prone to mood swings. One day Mr. Market would be exuberant, and the next he was despondent. His mood swings affected what he would do in his business. You are Mr. Market's business partner. When he's exuberant, he'll pay just about any price to buy you out. When he's despondent, he will sell his half of the business to you for pennies on the dollar just to get out. It's a really great way to personify the market because it is shockingly accurate when you watch the often illogical ups and downs, like the recent meme stock fad and SPAC stocks, many of which are now going bankrupt.

It is virtually impossible to figure out what the next hot thing will be, and even if you managed it, you probably couldn't repeat the feat. Then you'd also have to get out before the bubble burst, so you weren't left holding the bag (and capital losses). The easiest way to avoid all this? Just buy a broad-based index investment like an S&P 500 exchange-traded fund (ETF).

The S&P 500 Index is created to track the broader economy. It's also market-cap weighted, so, generally speaking, the stocks that are performing best will make up the largest portion of the index. This combination is important because it means you'll own a diversified investment, but it will be slightly biased toward the hottest sectors and investment trends. When market sentiment turns, you'll be overweight in sectors that are suddenly underperforming. But given the index's market weighting, you'll eventually shift toward the new hot sectors and styles.

And all you have to do is focus on saving money to put into the index ETF you've bought, such as SPDR S&P 500 ETF (SPY 0.91%). It's one of the oldest ETFs in existence, with a tiny expense ratio of 0.09% and a huge asset base of $430 billion. If you want a simple way to invest in the stock market, it is among the best options.

What if you like to invest?

That's great for an investor who doesn't actually find investing fun. But some people like to read annual reports, listen to conference calls, and dig through corporate presentations. (I know, I'm one of them.) You have to make sure you don't fall into the trap of trading emotionally like Mr. Market. It's not easy.

The first step is to stop listening to the media, particularly television stations dedicated to tracking Wall Street. They make money based on how many people are viewing their channel (via advertising) and are purposely trying to make everything that happens sound extra exciting. Some things are exciting, but most things aren't. Reading a paper, like The Wall Street Journal, with day-old news is probably good enough to keep you abreast of the market -- and it will keep you from overreacting "in the moment."

The next step is to design an investment approach that you can stick with through thick and thin. This is easier said than done. It took me years to wean myself off CNBC and focus on individual companies that had long histories of annual dividend increases, historically high yields when I bought them, and business models that I believed could stand the test of time. Basically, I'm trying to find well-run companies that are trading cheaply and that pay me well to own them while I wait for a business recovery. Your magic investment formula might be (and probably will be) different.

But this approach has led me to buy and stick with Dividend King Stanley Black & Decker, a deeply out-of-favor industrial stock that is just starting to turn its business around. Hormel Foods is another stock that fits with my investment approach today, and I've added to my position multiple times despite the company's sluggish stock price.

What gives me confidence in sticking it out with these two unloved stocks? In years past, my approach led me to Procter & Gamble, Nucor, and General Mills, each of which has produced sizable capital gains for me since I've owned them. So I'm confident in sticking with Stanley Black & Decker and Hormel, as long as something fundamental doesn't shift at either company. Most importantly, the market's broader gyrations play no role in my thinking.

Ignore the trends and stick to what works for you

Honestly, the big story here is that you can't control what sectors or investment styles are hot at any given time. And you shouldn't try to. It is far better to ignore the cross-currents on Wall Street and focus on a long-term plan. The easiest is to simply buy a broad-based index fund and focus all your time and attention on saving money. More complex, but more enjoyable in my book, is to figure out a way of investing that works for you and to stick with it through thick and thin.