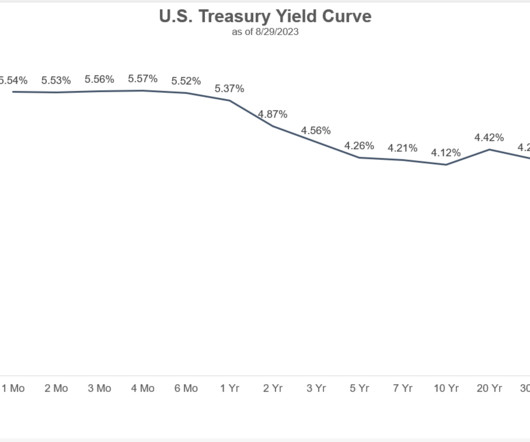

A Closer Look at Risk & Reward in Bonds Right Now

A Wealth of Common Sense

AUGUST 31, 2023

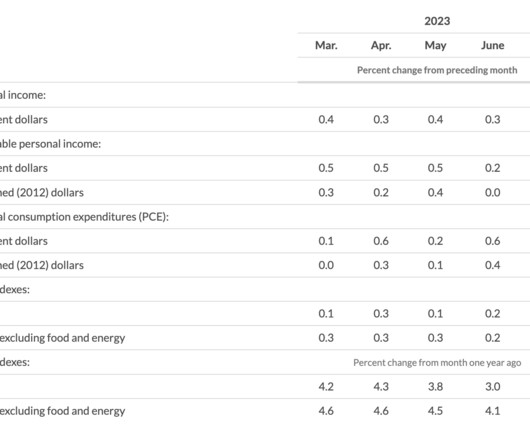

Jonathan Novy, one of our advisors and insurance experts at Ritholtz Wealth, joined me this week to discuss questions about emergency funds, investing when you don’t have a 401k, annuity yields and long-term care insurance. Further Reading: Why I’m More Worried About the Bond Market Than the Stock Market 1The same is true of CDs. I looked at 5 year CD yields at Marcus today.

Let's personalize your content