Exit Ready Roundup: May 2024

What fees can business owners expect from M&A advisory firms?

It’s hard to get a data-driven read on many aspects of the elusive lower middle market, especially on a topic as sensitive as M&A advisory fees.

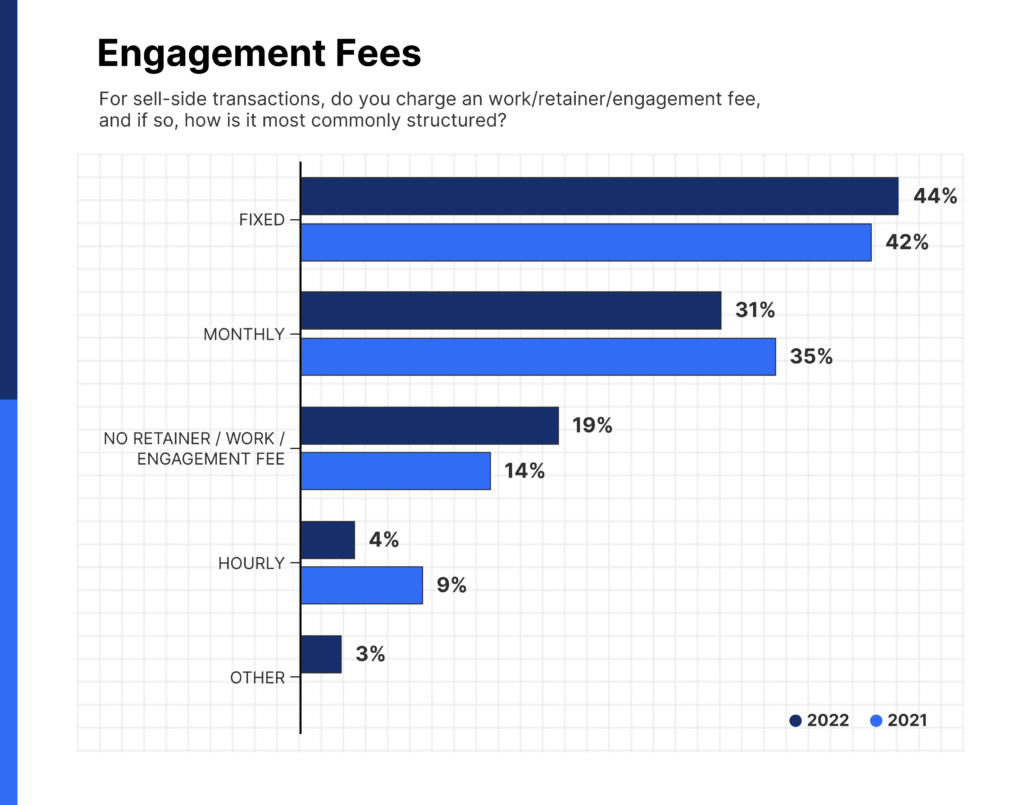

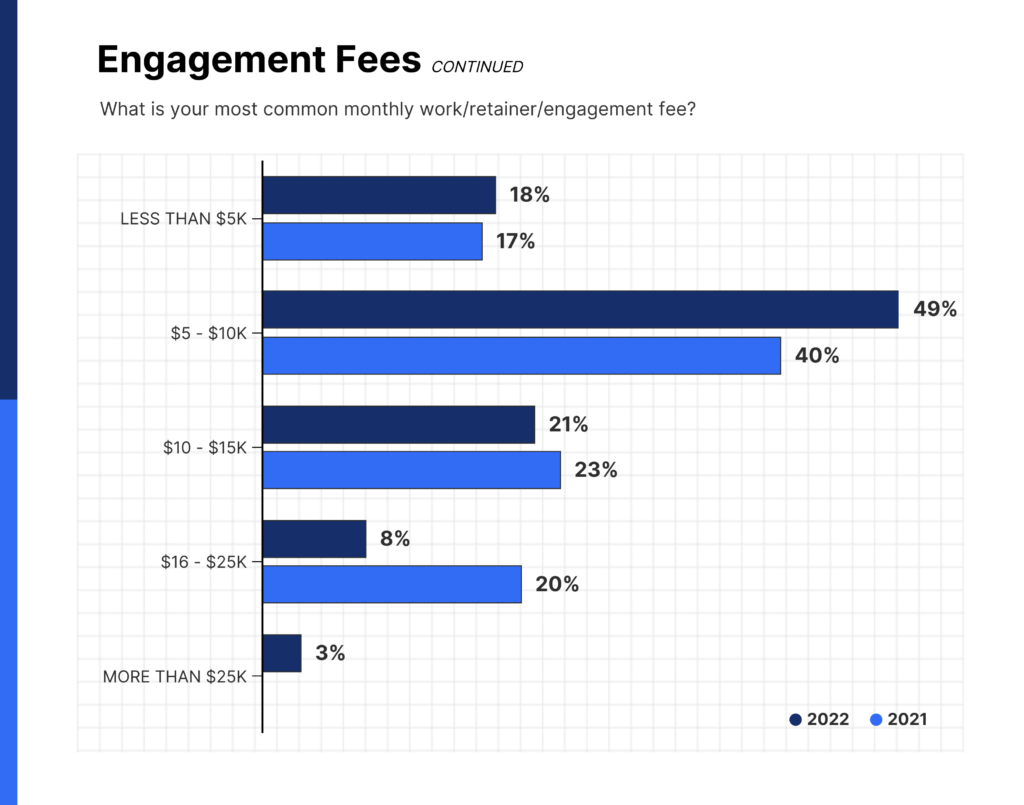

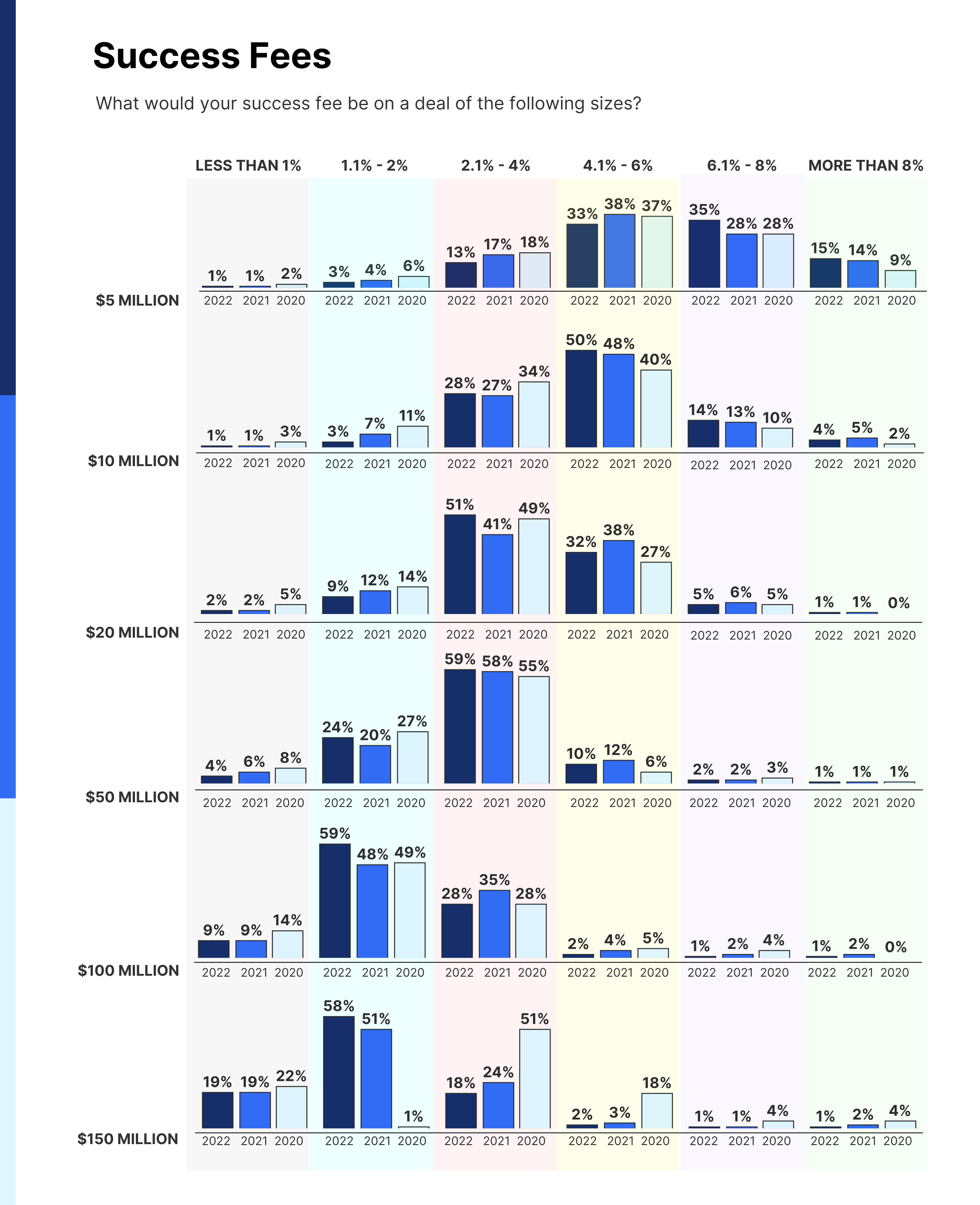

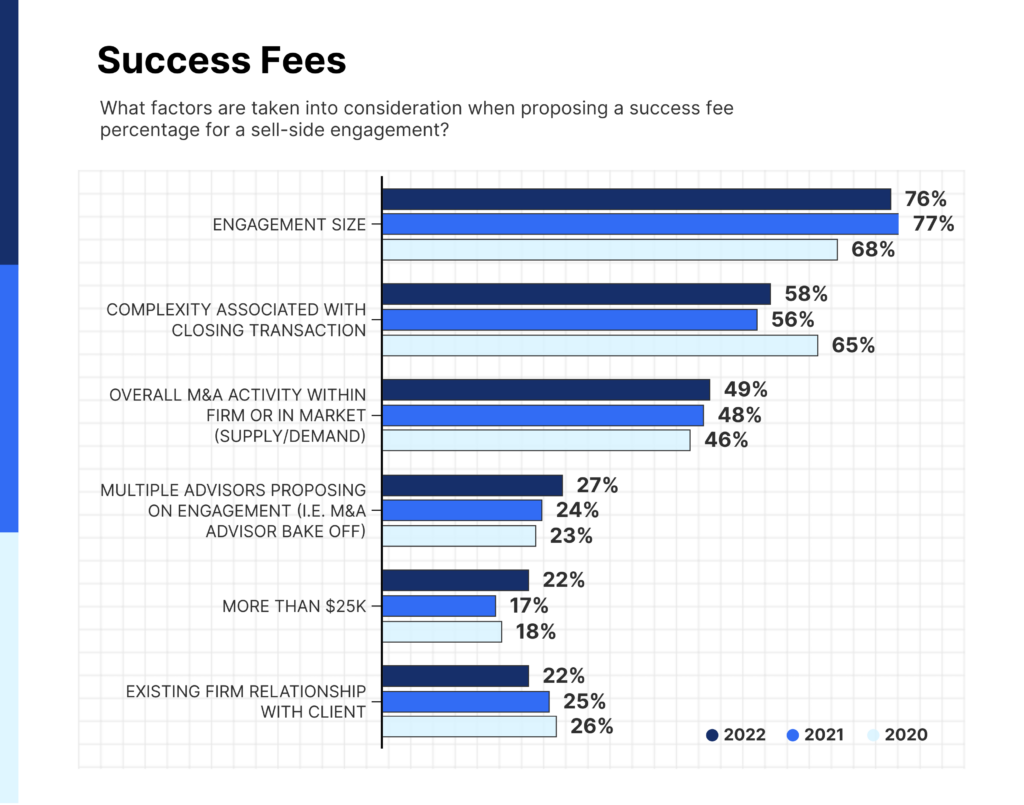

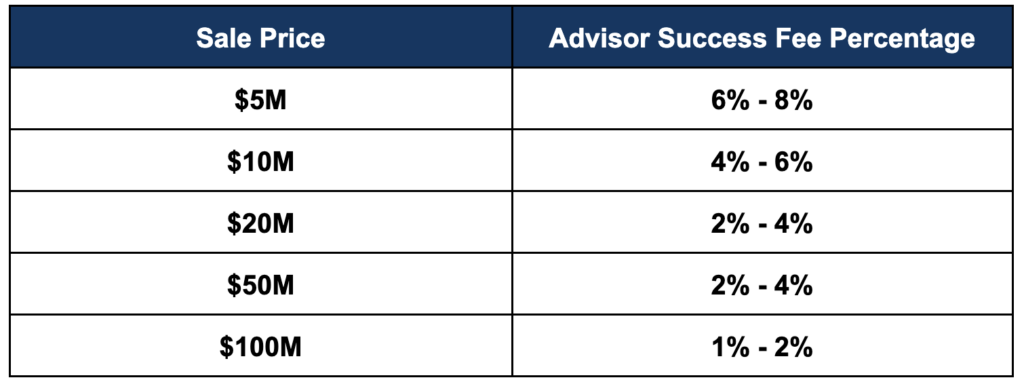

Nearly every M&A advisor structures their fees as some combination of a retainer and success fee. The split between retainer and success fee, along with how both are structured, have the biggest impact on an M&A advisor’s incentives. Understanding each can help you decide how to negotiate fees as you work with advisors.

Earlier this year, Axial partnered with Firmex and Divestopedia on the Annual M&A Fee Guide, the authoritative source on M&A fees for sell-side engagements in the middle market.

We gathered data from more than 250 Axial M&A advisory members.

Looking to hire an M&A advisor?

M&A advisors, like everyone else, are driven by incentives.

In turn, the purpose of fees in an exit or capital raise process is to align incentives between the business owner and M&A advisor. Ensuring that an advisor will push for the right outcome for your company comes down to getting the fee and engagement structure right.

If the fee arrangement isn’t well-structured, advisors can become conflicted. A lackluster fee arrangement can incentivize an advisor to sell the company for less money more quickly. That way they can move on to the next deal and their next fee.

This means that, as a business owner, you’ll have to decide whether you want a deal closed faster or for more money. The choice can have a significant impact on which banker to use and how to structure the fees.

Ensuring the incentives are aligned with your expectations will help drive the deal to the right result.

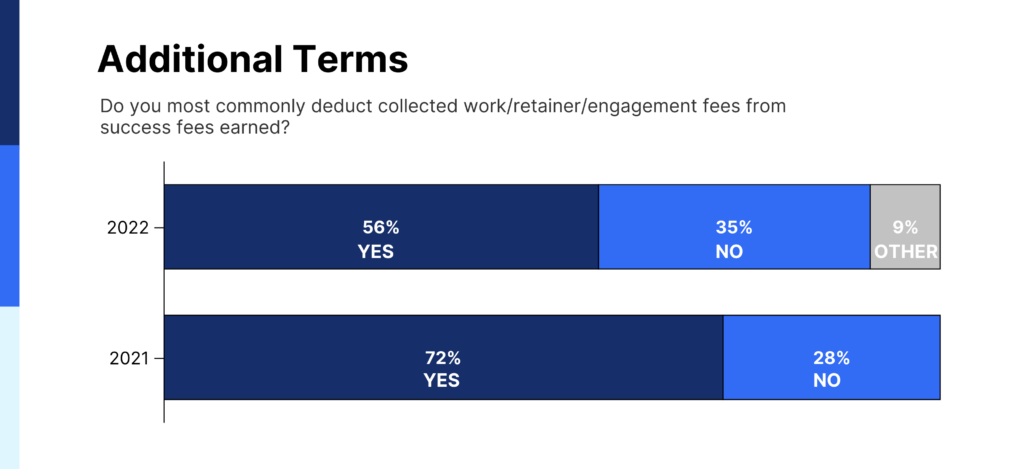

Below, you can find a 2021 vs. 2022 comparison of advisors’ fee structures across retainers and success fees. Once again, these are the survey results from 250 Axial M&A Advisory firms.