One of my favorite pop culture developments in recent years is the famous person press tour.

If you write a new book or have a new movie or TV show coming out, you have to talk to every outlet imaginable to sell your project. There is so much content and so much competition for our attention these days that even uber-successful people are forced to make the hard sell.

That means going on every big podcast. Then there are the morning shows, probably some sports-pop culture outlets and even a GQ or Rolling Stone profile.

There is no mono-culture anymore, so you have to flood all available channels in order to get the word out.

Jerry Seinfeld has been on an all-out media blitz these past few weeks to promote his new movie on Netflix.1

My favorite interview was his appearance on the Blocks Podcast with fellow comedian Neal Brennan. The two comics are friends, so Seinfeld seemed comfortable enough to wax poetic on a number of different topics.

My finance brain was immediately drawn to their discussion about money. Jerry talked about how money culture changed forever in the 1980s:

SEINFELD: In the seventies, this is the tragic turn of American culture. And this was explained to me by Mario Joiner who cracked this puzzle that I could not figure out what the hell happened. That money became everything. What happened because it was not like that in the seventies. In the seventies, it’s how cool is your job? How cool is what you’re doing? If your job’s cooler than my job, you beat me.

BRENNAN: And no one said, how much are you making?

SEINFELD: Oh, you’re doing okay. You’re making this? Yeah. Who cares? And Mario Joiner explained this to me. He said the eighties was the first time that young guys could make a lot of money fast.

Never existed before. Rich guys were Aristotle Onassis, Andrew Carnegie, shipping, iron. You couldn’t make a lot of money fast in those days.

And it has poisoned our culture to this day. It’s poison.

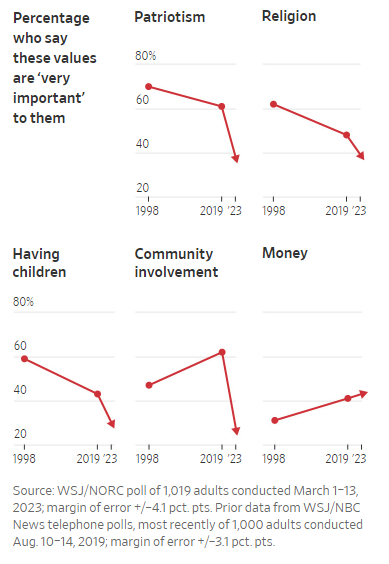

The Wall Street Journal had a poll last year that shows the share of Americans who say patriotism, religion, having children and community involvement are very important to them have taken a nosedive in recent decades. But look at the importance of money:

It just continues to rise.

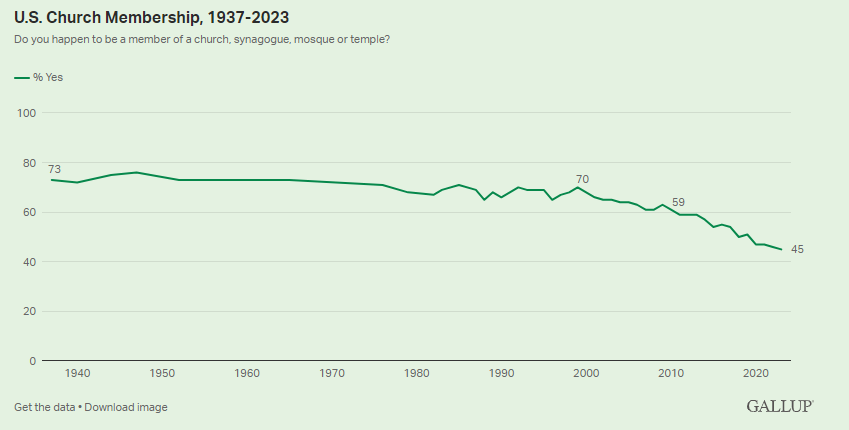

You have to take most surveys with a grain of salt but it is true in many ways that money has replaced the institutions previous generations valued. Just look at the trend in church membership in the United States:

So what happened? When did money become a deity in our society?

The growth of the finance industry in the 1980s certainly played a role in what Seinfeld is talking about. Charley Ellis once described what it was like working Wall Street back in the 1960s when he went into finance:

The work was interesting, but nobody expected to make much money–unless you uncovered a great growth stock, which was what we all secretly hoped to do. MBAs were uncommon. PhDs were never seen. Commissions still averaged 40 cents a share. All trading was paper based. Messengers with huge black boxes on wheels, filled with stock and bond certificates, scurried from broker to broker trying to complete “good deliveries” of stock and bond certificates.

The 1980s gave us Gordon Gekko, junk bonds, more securitized products, derivatives and Wall Street as a destination for bright young people. The dualing bull markets in stocks and bonds also helped make people rich. The financialization of everything is a trend that has continued to this day.

The financial and insurance industries comprised around 1.5% of GDP by the mid-19th century. By the end of World War II, it was only up to 2.5% of the pie. Finance was a fairly stable 4% of the economy through the 1960s and 1970s.

The biggest jump on record started in the 1980s. By the onset of the Great Financial Crisis, the finance industry accounted for more than 8% of GDP, which is roughly where it stands today.

A decent chunk of that growth started in the 1990s as Wall Street financed the IT revolution. Tech is another industry that has minted an astonishing number of rich young people in the past few decades.1

Most people didn’t need these numbers to know Seinfeld’s theory checks out. Americans are obsessed with money. It’s one of the things that makes us great and miserable at the same time.

I’m not suggesting money isn’t important. It is. Money can buy security, comfort, health and a better standard of living. Maybe money can’t buy happiness but it’s much easier to avoid misery if you have enough.

The problem is money can’t fill the void in your life.

Seinfeld says fulfilling work is the solution to the poisons of money:

Okay. I had a bunch of kids around the table last night. And I said to them, some of them are starting to work. I said, if your work is unfulfilling, the money will be too.

Comedians are the modern-day philosophers.

The whole interview is worth a listen:

Further Reading:

Timeless Themes From the Movie Wall Street

1I didn’t watch it yet but I’ll give it a try eventually.

2Finance and tech also make up nearly 45% of U.S. stock market capitalization.